personal loan to improve credit score

When it comes to a personal loan, the very first step is to get training on how to make responsible use of the money. Because, in the event that you miss a repayment, there is a possibility that your credit score score would be negatively damaged. Don’t forget that your ability to properly manage your personal finances is reflected in your credit rating score, so keep in mind that “that a” is a credit rating score.

In addition, it plays a defining role in the event that you apply for a mortgage of any kind, regardless of whether it is secured or unsecured. It is recommended that you submit an application for a mortgage that is somewhat bigger than what is needed so that you will be certain to find the cash to pay all bills that are necessary and still have some money left over to ensure that your checking account remains current.

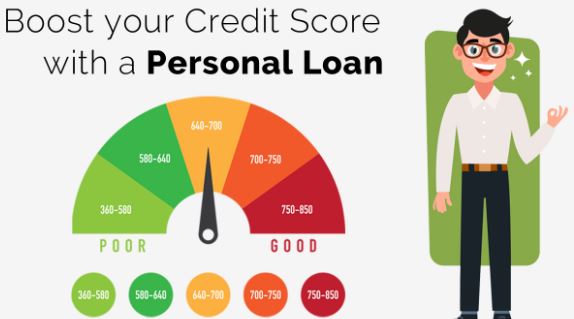

A person’s credit score may be thought of as a number that represents that person’s current financial situation and is assigned a score between 300 and 850. When it comes to matters pertaining to finances, a person is said to have an excellent credit rating score if they are financially secure and have a high amount of wealth.

If, on the other hand, a person’s financial situation is precisely the opposite of what is described above, then that individual has a poor credit score rating score. When determining a person’s credit score rating, financial organisations may take into consideration a variety of factors; nonetheless, the range of possible credit score rating scores for individuals is normally between 300 and 850.

One kind of loan that may be provided by online lenders, traditional banks, and credit unions is known as a non-public mortgage. This type of loan can aid you in carrying out your ambitions, whether they include starting a little business or making a significant acquisition.

Although private loans are likely to have decrease rates of interest than bank playing cards, you should use them to consolidate a number of bank card debts right into a single lower-cost month-to-month cost. This may be accomplished by utilising the cash you get from the consolidation to pay off the higher-interest debts first.

Now, your credit score rating is formulated by taking into consideration quite a few characteristics derived from your credit rating experiences. This results in the formation of your credit score rating. These encounters are used for the purpose of tracking your historical prior of use of the credit score rating over the course of seven years.

These credit rating experiences include information such as the amount of one’s available credit rating that has been used up to this point, the kind of credit rating that one has, the age of one’s credit rating accounts, and other similar details.

whether or not an individual has filed for bankruptcy, liens have been filed against them, acts of debt collection have been conducted against them, an individual’s complete open lines of credit rating, together with the most recent queries for hard credit rating.

Personal loans, just like any other kind of credit rating, have the potential to have an influence on your overall credit rating score. The tactic of using a personal mortgage for one’s own purposes before paying it off may be used to achieve this goal.

Continue reading if you are interested in finding out more about the backdrop around the topic of personal loans and how they might wind up hurting your credit rating. There are a lot of ways, some of which are given below, in which your credit score might be influenced by personal loans, and some of these ways are as follows:

The ratio of a person’s total debts to their annual income is often understood to be a measurement of the proportion of one’s earnings that goes toward paying off one’s debts. If you want to persuade lenders that you’ll be in a position to pay back the mortgage that you’ve got obtained from them, the quantity of money that you just simply get as wages is believed to be one of many crucial components that proves this.

Numerous financial institutions have provided you with their very own debt-to-income ratio so that their in-house credit rating scores may make use of it as a kind of credit rating consideration.

Do not fall into the trap of thinking that having an excessive amount of a mortgage would negatively affect your credit score rating. This is not true. The ratio of your debt to your income would increase, which would make it impossible for you to apply for further loans in the future without the risk of having your software refused or denied. This would be the primary and most significant harm that it may cause.

When loan payments are made on time, the credit score rating scores will increase

As soon as your mortgage is approved, it is imperative that you make on-time and complete payments toward the principal and interest on the loan every month. A delay in making a payment might potentially have a substantial impact on the status of your credit rating score.

On the other hand, in the event that you complete the payments on time each month, then your credit score rating score will skyrocket, resulting in an overall positive score. This will not only add your name to the list of preferred borrowers’ files, but it will also end up being beneficial to you in the long run.

Due to the fact that your payment history accounts for around 35 percent of your credit score, making on-time payments on loans is vital in situations such as these in order to maintain a positive standing with your credit score.

Choice is a component that goes into the construction of your credit score rating type

Your credit rating score is comprised of around five different factors, each of which contributes a certain amount. These are comprised of the related charge historical previous, the scale of the credit score rating historical previous, the usage ratio of the credit score rating, the credit score rating mix, and new inquiries of the credit score rating in accordance with FICO®.

Your credit score combinations only account for roughly 35 percent of your total credit score, however in the event of a personal mortgage, you’ll have a different mix of the various types of credit scores. This particular combination of several credit score scores is taken into consideration at an exceptionally high degree of approval by the collectors and lenders.

Loans are required to pay an origination fee

You will find that a lot of the lenders will ultimately charge you an origination fee. This fee cannot be avoided at any cost and will be subtracted immediately from the total amount that will be paid back on the mortgage.

The amount of the mortgage that you are planning to borrow will determine how much you will have to pay in origination costs. If money are received late, this might result in an overdraft caused by late fees and payments. Due to the fact that this is the case, you should just make certain that you pay the whole reimbursement for each month before the deadline.

In the context of money, avoiding fines is of utmost importance

If you pay off your portion of the mortgage earlier than the date that was originally agreed upon, several of the credit score rating lenders are likely to charge you an extra fee. The reason for this is that they are trying to find a reasonable amount of interest to charge on your mortgage.

Now that you have paid off your portion of the mortgage earlier than the due date, the lender stands to lose out on the curiosity that they would have most likely earned in the event that you had not paid off the debt shortly sufficient earlier than the due date.